Appendix B

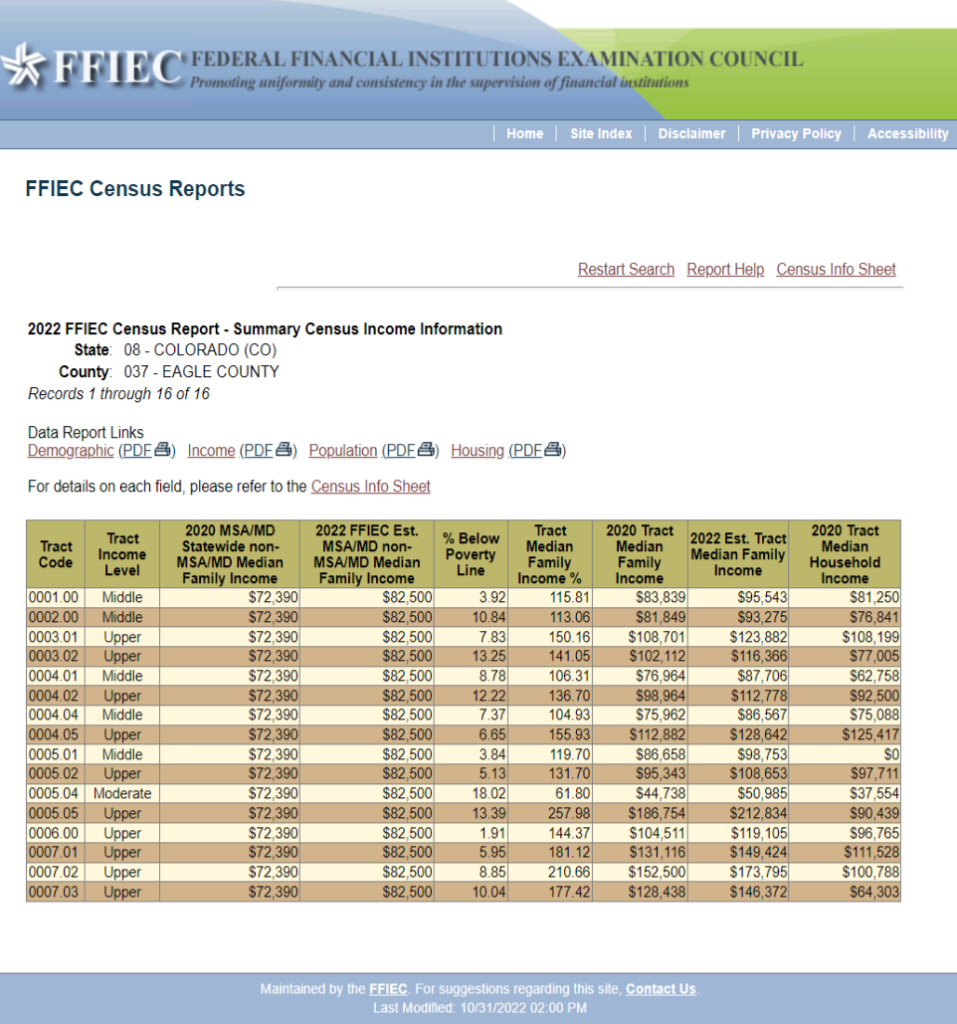

Table 1:

Census Tracts within the Battle Bank Assessment Area.

2022 FFIEC Census Report – Summary Census Demographic Information

Eagle County Background

The Battle Bank Assessment Area is comprised of Eagle County Colorado.

The Eagle County housing market has been exceptionally strong for several years and continues to show strong performance due to long-term trends in recreation and retirement location choices and shifts in housing selection choices due to the COVID-19 pandemic. Eagle County hosts a bimodal housing and income market with second homeowners and wealthy full-time residents pricing out workforce households and other communities. Eagle County is surrounded by mountains and has a high proportion of land that is not suitable for developing workforce and low-income housing. It is a rare week that goes by without a news story in local or regional journals about the difficulty of obtaining or retaining employees or the inaccessibility of appropriate housing for workers and their families.

While the supply of residences for the higher-end consumer has been readily satisfied by developers, Eagle County is projected to continue to have limited growth in workforce and low-income housing.

The overall state’s population growth is also a contributor to the demand for housing, which has driven prices upward and put stress on the available housing inventory. According to BestPlaces.net, Eagle County’s current median home value is currently $1,135,500 which is a 9.4% increase from last year. This surge is outpacing the increase in workforce median household incomes, with median sales prices increasing 138% over the last ten years, and household incomes only growing by 21%. While homebuyers have experienced an increase in prices, renters are also experiencing higher rents. For example, according to rentdata.org, over a five-year period, median rents for a 2-bedroom unit in Eagle County have increased from $1,208 in 2016 to $2,030 in 2023. This is indicative of the overall housing market in the AA and Colorado as a whole.

Due to the cost of land and rising construction costs, most new developments, including most multi-family projects, are geared toward high-end condos, time-shares, and second homeowners. All of this conspires to make it difficult to develop housing that is priced such that it is affordable for local workers. In the Eagle County, as in most mountain communities, developers are generally required to provide some units in proposed developments at an affordable level for workforce families, or as deed-restricted properties. In addition, the various cities and towns in the county have built and own some housing with the purpose of keeping it affordable for working families. None of these solutions, while helpful, have been able to keep up with the demand for affordable workforce housing.

There have been other factors that have negatively impacted the affordable housing problem in the Assessment Area. Ironically, low interest rates have exacerbated the problem, which seems counter intuitive. However, lower interest rates generally end up driving up the value of real estate, including land for development. The Covid-19 pandemic has also negatively impacted housing affordability in most Colorado mountain communities. With the shift to working from home and thus away from working in an office building, many high earners have chosen to move out of dense metropolitan areas. No longer needing to live within a reasonable commute from their office, many are choosing the mountain lifestyle, and their arrival in mountain communities has created new demand for housing, thus driving up home and land values.

There have been many studies done to try to solve the affordable housing issue, but thus far, a workable solution has been elusive.

Over the last ten years Colorado has ranked as the sixth fastest growing state; however, in 2022 it fell out of the top ten fastest growing and has now dropped to 19th fastest growing. Colorado will likely continue to experience significant population growth from in-migration and natural increases. Some research projects that the number of Colorado households will continue to grow steadily into the future while persons per household decrease with continued challenges in housing, education and transportation. As the market demand for housing increases with the pace of growth, it will continue to outpace available inventory and the rise in home prices will remain a barrier to homeownership for lower-income households.